Professional Property Services Tailored for Successful Building Financial Investment Strategies

In the facility world of residential property investment, the demand for skilled real estate solutions that are thoroughly customized to private financial investment techniques is critical. These solutions go beyond plain deals; they incorporate an extensive approach that includes personalized market analysis, tactical advice in residential property acquisitions, careful development of investment approaches, and continuous profile administration.

Tailored Market Analysis

When beginning on residential or commercial property financial investments, an essential action is performing a tailored market analysis to make educated choices. This evaluation involves an extensive analysis of various elements that can influence the efficiency and possibility of a real estate investment. By delving into facets such as neighborhood market trends, supply and demand dynamics, financial indications, and group changes, investors can get useful insights right into the market landscape.

A tailored market analysis makes it possible for financiers to determine rewarding chances, alleviate risks, and optimize their investment techniques. Recognizing the unique attributes of a specific market section allows investors to align their purposes with market problems effectively. Furthermore, this analysis encourages investors to anticipate future trends, adapt to market fluctuations, and make data-driven choices that drive success.

Home Option Advice

Having carried out a tailored market analysis to recognize the dynamics and possibility of real estate investments, the following important step is to offer experienced guidance on choosing properties that align with calculated financial investment purposes (Belize Real Estate). Residential or commercial property choice support entails a thorough approach that considers various elements such as place, residential property kind, market trends, and possibility for worth recognition

Professional realty solutions supply customers insights into market problems, arising chances, and possible risks associated with various homes. By leveraging sector expertise and data-driven evaluation, specialists can recognize properties that not just fulfill the customer's investment goals but additionally supply long-lasting development possibility.

In addition, property option guidance likewise involves analyzing the property's problem, prospective renovation demands, and rental earnings prospects for capitalists seeking to produce passive revenue. By offering comprehensive advice on residential property selection, realty professionals can help capitalists make informed choices that align with their economic goals and take the chance of tolerance, ultimately optimizing the potential for effective home financial investments.

Financial Investment Approach Growth

Crafting a durable financial investment approach is crucial for maximizing returns and mitigating threats in realty endeavors. To establish a successful investment strategy, it is crucial to conduct thorough marketing research and economic analysis. Understanding market trends, building cycles, and financial signs can help investors make educated decisions. In addition, examining private risk resistance, investment objectives, and time perspective is essential in customizing a method that lines up with specific goals.

Diversification is another essential aspect in financial investment technique development. By spreading out financial investments throughout different property types, areas, and investment lorries, investors can minimize overall danger direct exposure. Furthermore, including exit methods right into the initial financial investment strategy is important for optimizing returns and guaranteeing liquidity when required.

On a regular basis reviewing and adjusting the investment technique in action to market adjustments and efficiency analyses is vital for long-term success. Seeking guidance from skilled property experts can give beneficial understandings and proficiency in developing a customized investment strategy that suits individual demands and objectives.

Threat Reduction Solutions

Creating reliable danger reduction services is important for protecting property investments against possible hazards and uncertainties. In the world of genuine estate, numerous threats can influence the worth and earnings of residential or commercial properties, ranging from market variations and financial slumps to unexpected maintenance prices or legal issues. To address these obstacles, capitalists and building proprietors need to implement aggressive steps that can help decrease the effect of risks and make certain the long-lasting success of their investments.

One trick threat mitigation remedy is diversification. By spreading financial investments across various sorts of properties or geographical locations, financiers can reduce their direct exposure to particular market threats. Carrying out thorough due persistance before making investment choices is likewise crucial to determine and assess prospective threats precisely. Applying risk monitoring strategies, such as find a real estate broker acquiring insurance policy coverage for building damage or obligation concerns, can provide added defense and assurance.

In addition, remaining informed about market trends and policies, preserving an economic barrier for unanticipated expenditures, and dealing with experienced realty experts can even more improve danger mitigation efforts. By proactively attending to prospective dangers and unpredictabilities, financiers can much better place themselves to attain effective building financial investment methods.

Continuous Portfolio Management

Regularly reviewing the financial efficiency of each residential property, examining market fads, and examining the general profile's alignment with investment objectives are key elements of recurring portfolio administration. Belize Investment Property. By remaining my sources abreast of market changes and adjusting techniques appropriately, financiers can reduce dangers and utilize on arising chances

Fundamentally, recurring portfolio administration is foreclosures near me an aggressive strategy that aims to improve the general efficiency and worth of a real estate investment portfolio. By carrying out audio monitoring techniques and staying agile in feedback to market dynamics, financiers can place themselves for continual success in the property investment market.

Conclusion

Finally, skilled genuine estate solutions use customized market analysis, residential property option advice, investment method growth, risk reduction remedies, and recurring profile monitoring. These solutions are necessary for effective residential property financial investment methods. By using the proficiency of professionals in the area, capitalists can make educated decisions, reduce risks, and make the most of returns on their real estate financial investments. It is vital to seek specialized property solutions to attain long-lasting success in residential or commercial property investment undertakings.

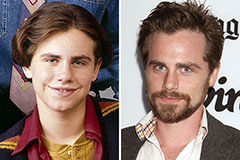

Rider Strong Then & Now!

Rider Strong Then & Now! Jenna Von Oy Then & Now!

Jenna Von Oy Then & Now! Kelly Le Brock Then & Now!

Kelly Le Brock Then & Now! Lucy Lawless Then & Now!

Lucy Lawless Then & Now! Terry Farrell Then & Now!

Terry Farrell Then & Now!